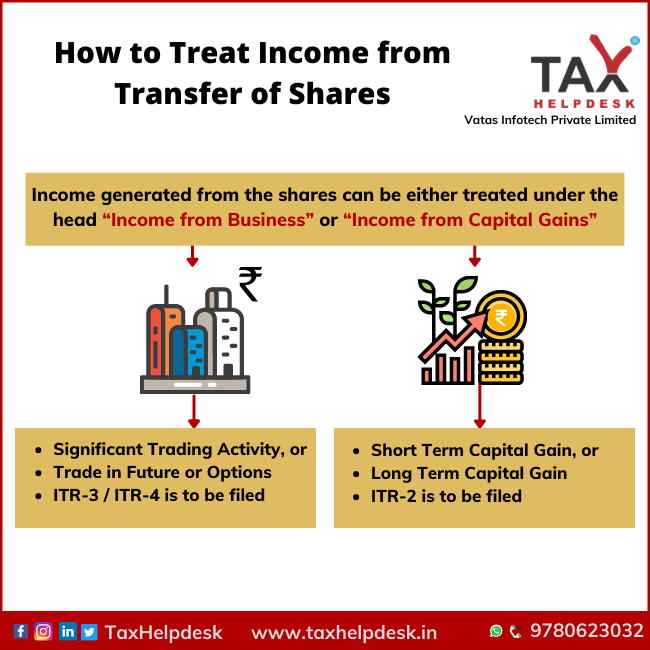

Shares Income is Capital Gain or Business Income|How to show shares income| Profit from Sale of Share - YouTube

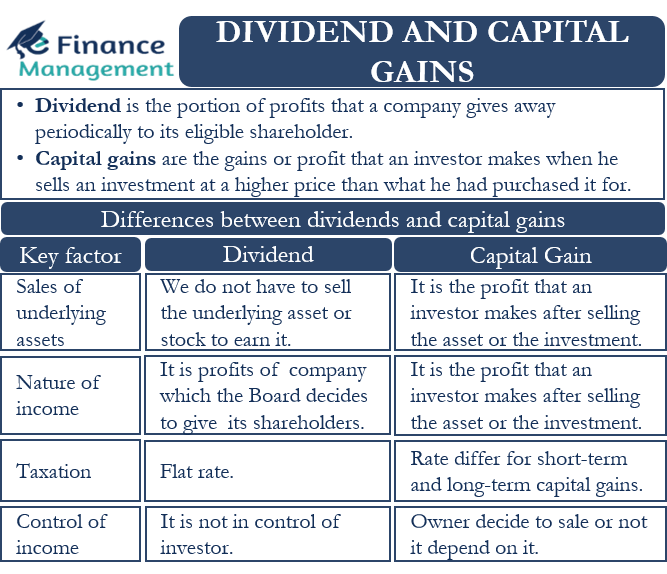

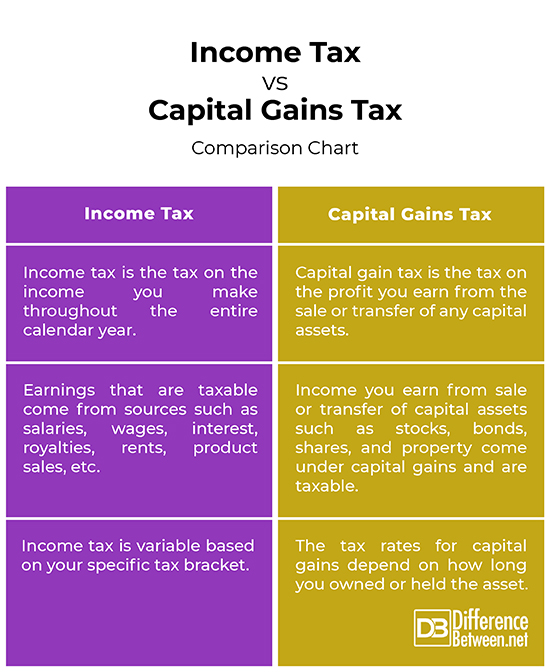

Capital Gains vs. Business Profits – Income Tax News, Judgments, Act, Analysis, Tax Planning, Advisory, E filing of returns, CA Students

Short term Capital Gain disposed off within a Short Span of time will not justify the gain to be treated as Business Income: ITAT

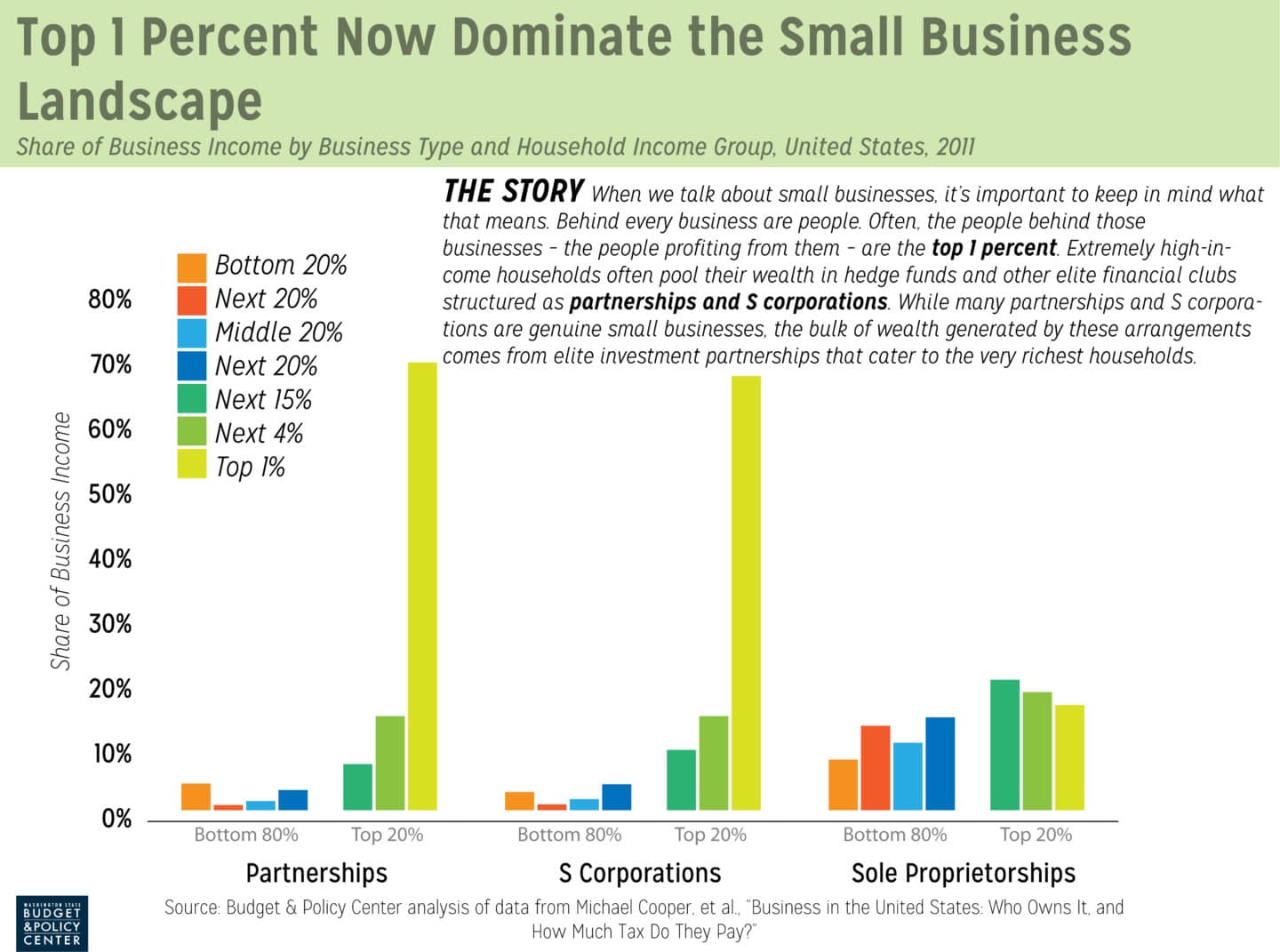

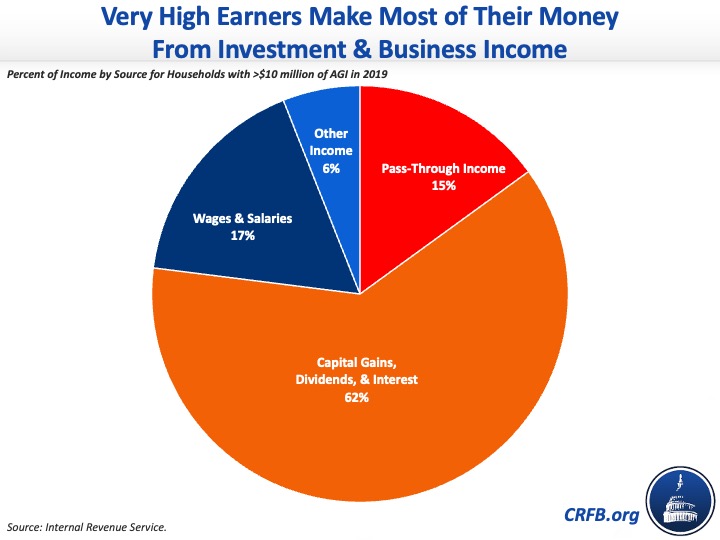

U.S. income inequality is worse and rising faster than policymakers probably realize - Equitable Growth

Hedge Funds vs. Mom-and-Pops: The Truth about Small Businesses and Closing the Capital Gains Tax Break - Budget and Policy Center

:max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg)